Independent Investing Strategies

Unlock professional stock strategies and powerful tools to manage your portfolio—without the overpriced financial advisor.

Strategy Summaries & Performance

Not sure which strategies to choose or how to allocate your investments?

No problem—we’re here to help. Below you’ll find clear summaries and performance insights for each of our five strategies to guide your decision-making.

We also recommend using a risk tolerance calculator, which you can easily find online. These tools help you determine the right investment mix based on your comfort with risk—just like the ones financial advisors use (though they rarely mention that you can access them yourself).

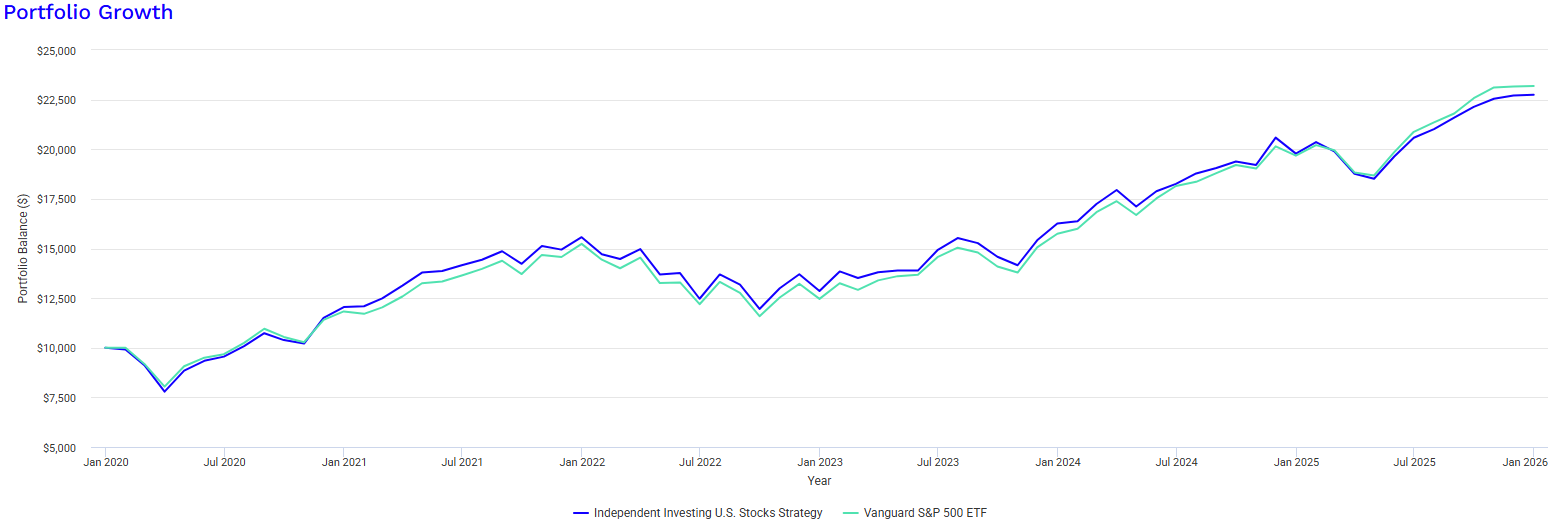

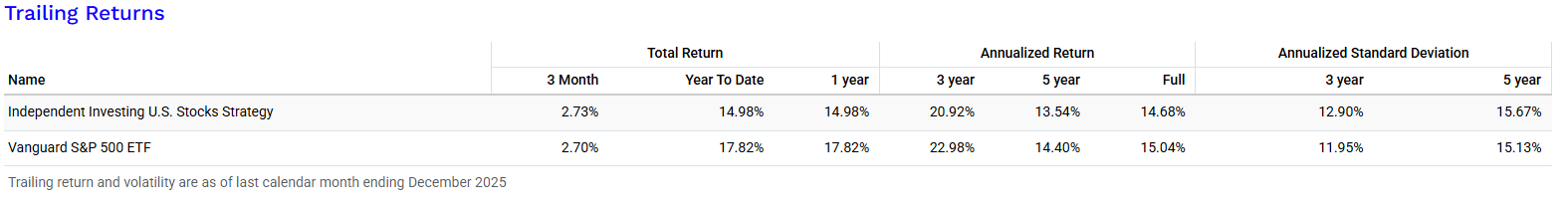

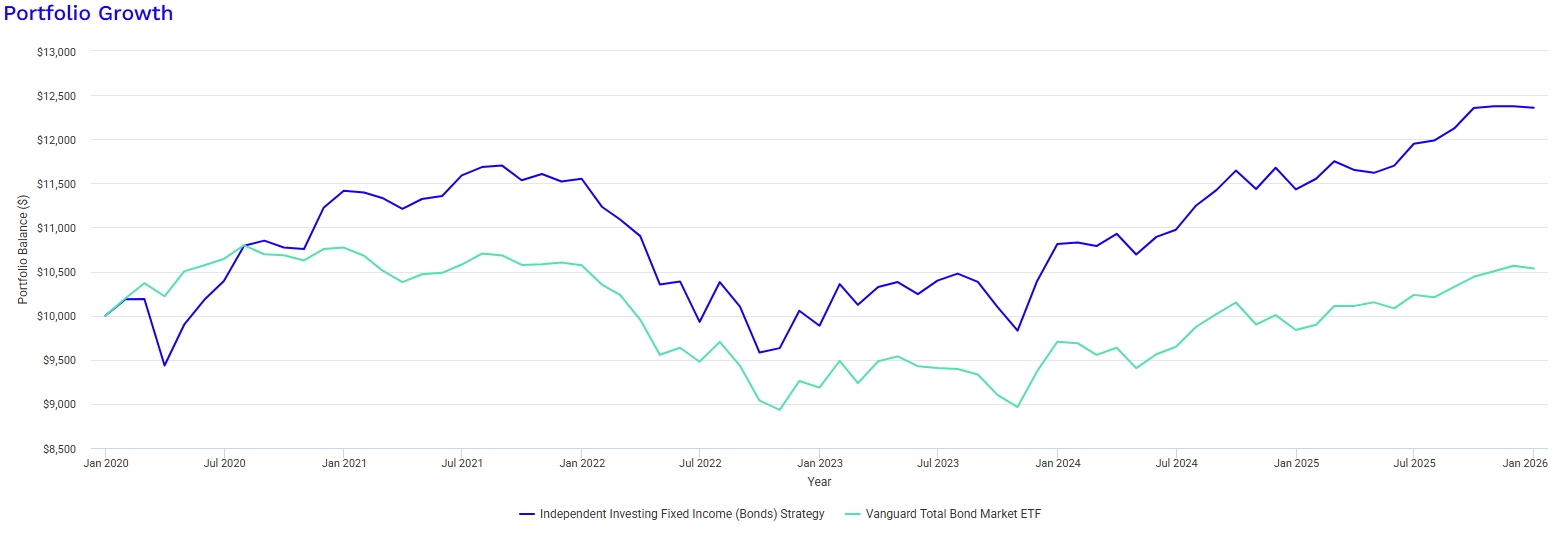

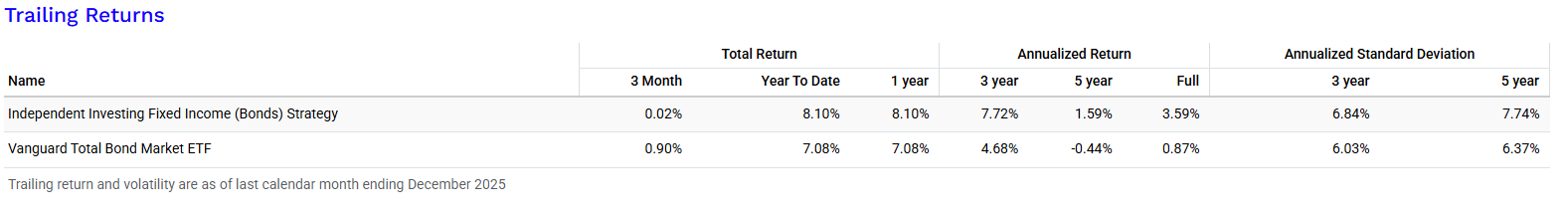

All Independent Investing strategies charts and graphs presented below show examples of a $10,000 investment into the strategy.

Independent Investing U.S. Stocks Strategy:

Summary:

Invests in ETFs that track major U.S. equity indices (e.g., S&P 500, Nasdaq) or specific sectors. Offers broad exposure to U.S. companies.

Common Uses:

Long-term growth, retirement planning, and general market diversification.

Risk Profile:

Moderate to high. Subject to market volatility and economic shifts. Diversification through ETFs helps reduce individual stock risk, but downturns can still impact performance.

Disclaimer: Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal. Data shown reflects hypothetical portfolios and not actual client accounts.

Data as of 1/21/2026. © 2026 Morningstar. All rights reserved. Morningstar and its content providers are not responsible for any losses resulting from use of this information.

Independent Investing Fixed Income (Bonds) Strategy:

Summary:

Includes ETFs holding government, corporate, or municipal bonds. Designed to generate income and preserve capital.

Common Uses:

Stable income, portfolio balance, and conservative investing.

Risk Profile:

Low to moderate. Sensitive to interest rate changes, credit risk, and inflation. Government bonds are typically safer; high-yield bonds carry more risk.

Disclaimer: Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal. Data shown reflects hypothetical portfolios and not actual client accounts.

Data as of 1/21/2026. © 2026 Morningstar. All rights reserved. Morningstar and its content providers are not responsible for any losses resulting from use of this information.

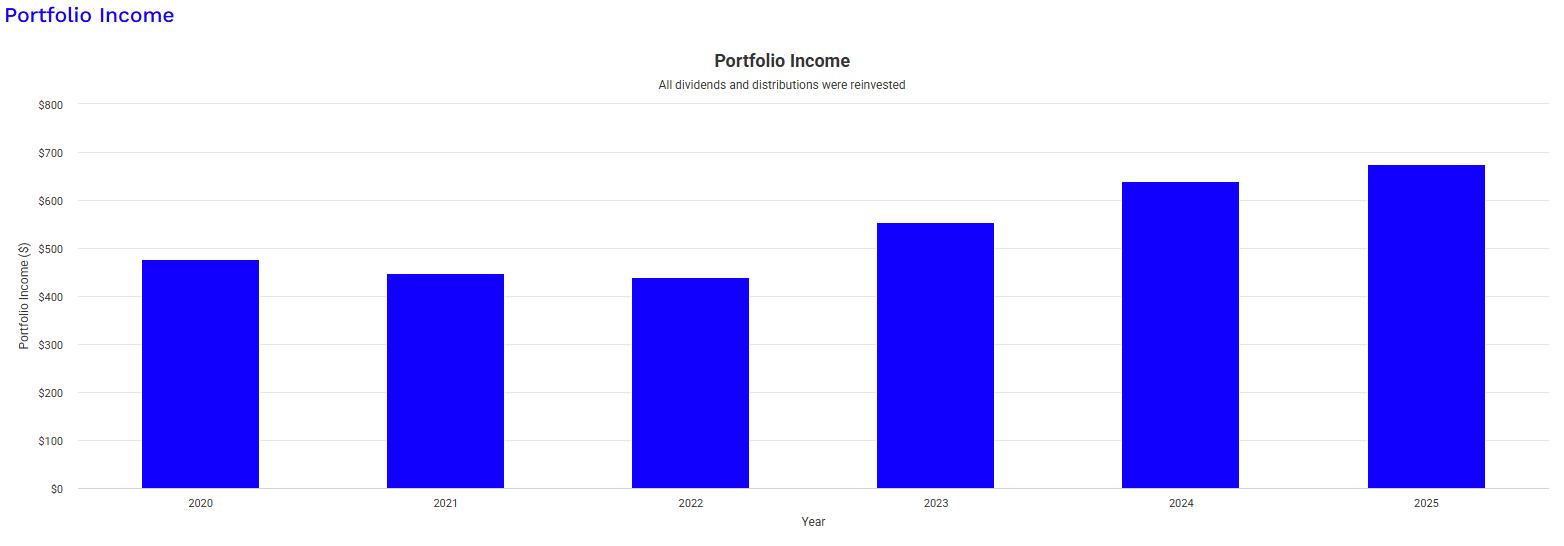

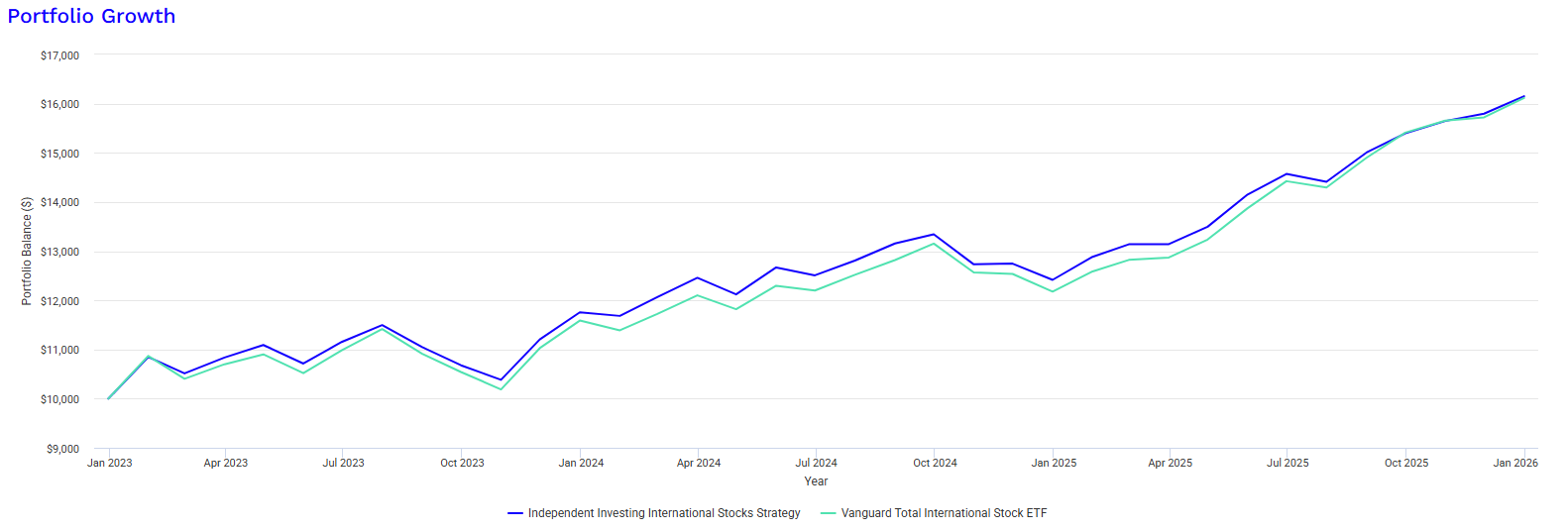

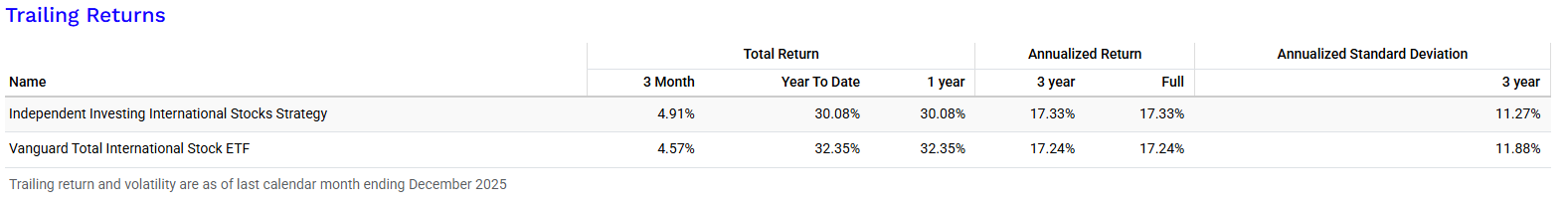

Independent Investing International Stocks Strategy:

Summary:

Invests in ETFs tracking global or regional equity indices (e.g., MSCI EAFE, emerging markets). Provides exposure to non-U.S. companies.

Common Uses:

Global diversification and hedging against U.S. market performance.

Risk Profile:

Moderate to high. Influenced by currency fluctuations, geopolitical events, and international market regulations. Emerging markets are generally riskier than developed ones.

Disclaimer: Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal. Data shown reflects hypothetical portfolios and not actual client accounts.

Data as of 1/21/2026. © 2026 Morningstar. All rights reserved. Morningstar and its content providers are not responsible for any losses resulting from use of this information.

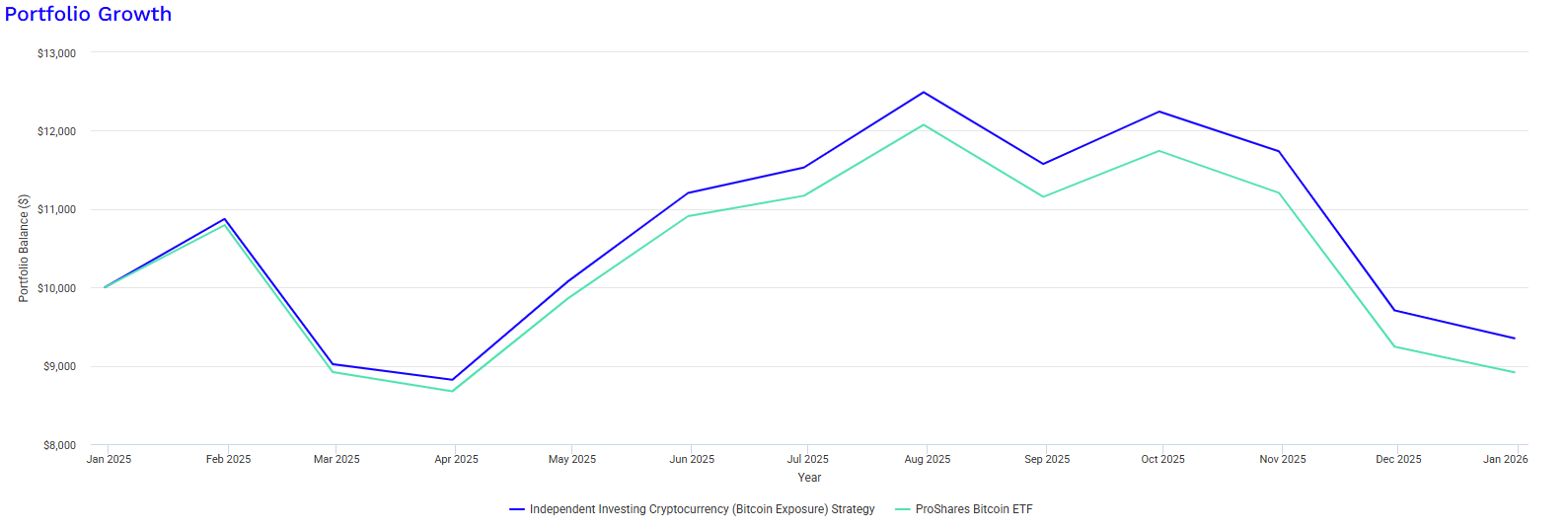

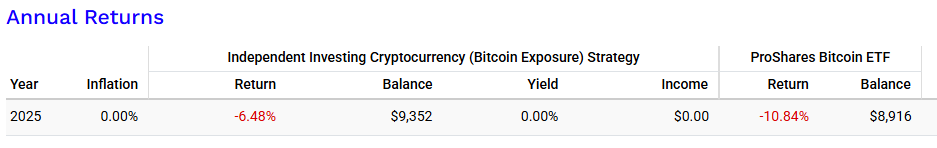

Independent Investing Cryptocurrency (Bitcoin Exposure) Strategy:

Summary:

Offers exposure to Bitcoin through ETFs that hold the asset directly or via futures contracts. Allows crypto investing without managing digital wallets.

Common Uses:

Speculative growth, diversification, and hedging against fiat currency risks.

Risk Profile:

Very high. Prone to extreme volatility, regulatory uncertainty, and market manipulation. ETFs help reduce some risks, but this strategy remains highly speculative.

Disclaimer: Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal. Data shown reflects hypothetical portfolios and not actual client accounts.

Data as of 1/21/2026. © 2026 Morningstar. All rights reserved. Morningstar and its content providers are not responsible for any losses resulting from use of this information.

Independent Investing Cash Strategy:

Summary:

Represents uninvested cash or money market funds focused on capital preservation and modest returns.

Common Uses:

Emergency savings, short-term goals, or holding funds before reinvestment.

Risk Profile:

Very low. Minimal volatility, but returns may not keep pace with inflation, potentially eroding purchasing power over time.

All Investment Products are Subject to Investment Risks, Including Possible Loss of Amount Invested.